Earned Income Tax Credit Awareness Day

The Earned Income Tax Credit (EITC)

What is the EITC?

- The EITC is a federal tax credit meant to assist low- and middle-income working people.

- If you owe federal taxes, the EITC reduces your liability. If your EITC would reduce your tax liability below zero, you can claim the difference as a refund.

How do I qualify for the EITC?

- You must –

- File a tax return (even if it’s not otherwise required);

- Be a U.S. citizen, the spouse of a U.S. citizen, or a resident alien all year;

- Have a valid Social Security number that allows you to work; and

- Have earned income as an employee or a business owner.

- You cannot –

- Be a qualifying child of another person;

- File as Married Filing Separately;

- Claim a foreign earned income exclusion; or

- Have excessive investment income.

What affects the amount of my EITC?

- It varies based on –

- Your income;

- Your marital status; and

- The number of qualifying children you have.

What happens if I make errors when claiming the EITC?

- The IRS may delay or deny the EITC portion of your refund.

- If the EITC is denied, you will need to pay back the amount paid in error plus interest and file an extra form the next time you want to claim the EITC.

- The IRS may be able to bar you from claiming the EITC in later taxable years in some circumstances.

How can I determine how much my EITC will be?

Use the IRS’s EITC Eligibility Tool

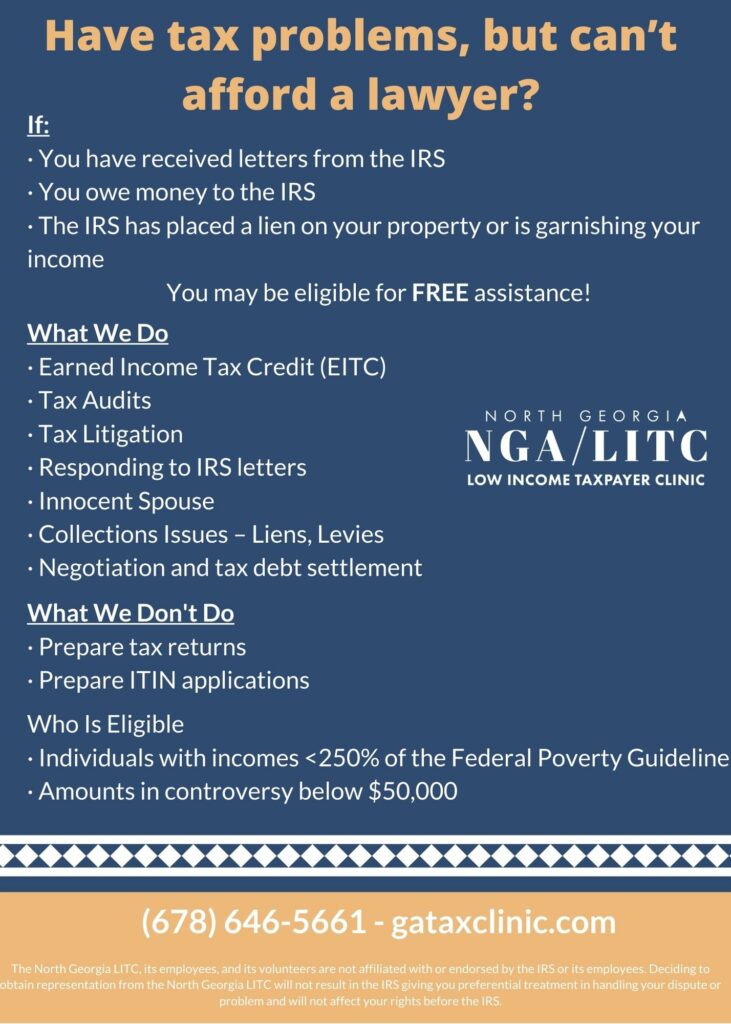

The North Georgia LITC, its employees, and its volunteers are not affiliated with or endorsed by the IRS or its employees. Deciding to obtain representation from the North Georgia LITC will not result in the IRS giving you preferential treatment in handling your dispute or problem and will not affect your rights before the IRS. The North Georgia LITC does not generally prepare tax returns or ITIN applications.

Recent Comments