by Eric Santos | Mar 3, 2021 | Uncategorized

At the North Georgia Low Income Tax Clinic, we have made it our mission to help families and individuals overcome financial hardship and achieve independence. Since 2019 we have assisted more than 130 people from across the state of Georgia in their journeys to make this mission a reality. Some of these amazing people have given us permission to share their stories. Our clients’ names have been omitted to preserve their privacy.

Terri and Joe are a married couple raising three children in North Georgia. They have supported their family by running a small auto repair and maintenance shop for years, and while they have struggled at times, they’ve always managed to make ends meet. In 2018, the IRS audited Terri and Joe. They denied a large portion of the business expense deductions that the couple had declared in several prior years. If the IRS had been successful in removing those deductions, Terri and Joe would have owed more money in taxes than their total, combined, take-home earnings in all those years combined. The stakes were high.

After initially attempting to resolve the issue themselves and filing a petition in the US Tax Court, Terri and Joe realized that they needed help to navigate the looming litigation effectively. They found their way to the North Georgia LITC. Our Executive Director, Eric Santos, was able to help Terri and Joe successfully defend nearly all of the business expense deductions that they had initially declared on their tax returns. If the IRS’s initial adjustments had been upheld, Terri and Joe would have owed the IRS more than $120,000 in additional taxes, interest, and penalties from the years at issue. In the end, they were able to resolve their case with adjustments resulting in less than $8,000 in total liability. Additionally, Eric was able to advise Terri and Joe about how to improve their recordkeeping practices to ensure that they are able to prepare and file their taxes more easily and more accurately in future years.

by Eric Santos | Mar 2, 2021 | Uncategorized

“Volunteering at the North Georgia Low Income Taxpayer Clinic is a rewarding experience because the work I do has a significant impact on clients’ financial and personal lives, especially during these hard times. The cases are challenging, but the clients are always kind and amazing to work with. It is a great privilege for me to listen to a client’s story and interact with people from different backgrounds and walks of life. I also get to expand my horizons by working on cases that are unique to the most vulnerable in our society. I highly recommend volunteering at the Clinic to anyone interested in the tax field or to anyone wanting to lend a helping hand.”

-Jarter Gao, Managing Attorney at the Gao Tax Law Firm

Join us! Help us provide financial stability to people in need click here VOLUNTEER

by Eric Santos | Feb 12, 2021 | Stories, Uncategorized

At the North Georgia Low Income Tax Clinic, we have made it our mission to help families and individuals overcome financial hardship and achieve independence. Since 2019 we have assisted more than 130 people from across the state of Georgia in their journeys to make this mission a reality. Some of these amazing people have given us permission to share their stories. Our clients’ names have been omitted to preserve their privacy.

Mr. and Mrs. Wilson were a typical Georgian couple working 9-5 jobs, saving for retirement, and building their American dream. In 2005, a spiral of unexpected and unfortunate events threw their lives into chaos. Within the same year, two of their parents were diagnosed with terminal illnesses. Both Mr. and Mrs. Wilson left their jobs to create more flexibility to support and care for their parents. In an effort to turn this hardship into an opportunity, they decided to invest in turning a former side project, a residential real estate business, into a full-time career. They knew that it was a risk, but they’d also made some good deals in the past, and if they were able to succeed, the new venture would give them the resources, time, and flexibility they needed to support their parents.

Unfortunately, life had other plans. Almost immediately, the Wilsons encountered a series of unexpected and debilitating obstacles. Their parents’ conditions continued to deteriorate and they experienced their own severe, personal health problems. Then, in 2007, less than a year after striking out on their own, the real estate market across the United States collapsed. The Wilsons’ fledgling business prospects dried up and they were forced to declare bankruptcy. They began to think they had run out of options.

As the Wilsons’ financial difficulties mounted, they drew on every resource they had to keep themselves afloat. They withdrew from the retirement accounts that they had carefully built up over years of work but, like many people in similarly trying situations, did not properly account for the tax consequences of these withdrawals. This left them in debt to the IRS and the Georgia Department of Revenue just as their final financial resources were running dry. They felt stressed and hopeless. After exploring every option they could find to help repair their finances and regain some of the stability they’d lost, the Wilsons found their way to the North Georgia Low Income Tax Clinic.

By the time the Wilsons arrived at our offices, they felt that they had lost everything. They were struggling to restart their careers in middle age and had become dependent on their surviving parents for financial support. They felt that their situation was impossible, that their debts would simply follow them for the rest of their lives.

With the assistance of our founder, Eric Santos, they were finally able to obtain some of the assistance they required. He helped them navigate the complexity of the federal and state tax systems and create a plan to resolve their issues and move forward. Mr. Santos helped the Wilsons apply to settle their existing tax debts. Ultimately, they were able to reduce their outstanding liability to the IRS and the Georgia Department of Revenue by over $17,000.

Through this forgiveness, the Wilsons have been able to escape the perpetual cycle of repayment and have gained the opportunity to restart. Through time and hard work, they have been able to rebuild not just financial stability, but their independence. After a decade of pain and stress, being debt-free has helped both Mr. and Mrs. Wilson have the time and energy to work, rebuild their savings, and regain some of their American dreams.

by Eric Santos | Jan 29, 2021 | Uncategorized

Today is Earned Income Tax Credit Awareness Day! The Earned Income Tax Credit, or EITC, is a credit that helps low- and middle-income families. More than one million Georgians claimed the EITC on their 2019 taxes, and the value of those claims exceeded $2.9 billion. You can check your eligibility for the EITC using the IRS’s EITC Calculator! (

https://lnkd.in/d6n7iZC)

The Earned Income Tax Credit (EITC)

What is the EITC?

- The EITC is a federal tax credit meant to assist low- and middle-income working people.

- If you owe federal taxes, the EITC reduces your liability. If your EITC would reduce your tax liability below zero, you can claim the difference as a refund.

How do I qualify for the EITC?

- You must –

- File a tax return (even if it’s not otherwise required);

- Be a U.S. citizen, the spouse of a U.S. citizen, or a resident alien all year;

- Have a valid Social Security number that allows you to work; and

- Have earned income as an employee or a business owner.

- You cannot –

- Be a qualifying child of another person;

- File as Married Filing Separately;

- Claim a foreign earned income exclusion; or

- Have excessive investment income.

What affects the amount of my EITC?

- It varies based on –

- Your income;

- Your marital status; and

- The number of qualifying children you have.

What happens if I make errors when claiming the EITC?

- The IRS may delay or deny the EITC portion of your refund.

- If the EITC is denied, you will need to pay back the amount paid in error plus interest and file an extra form the next time you want to claim the EITC.

- The IRS may be able to bar you from claiming the EITC in later taxable years in some circumstances.

How can I determine how much my EITC will be?

Use the IRS’s EITC Eligibility Tool

The North Georgia LITC, its employees, and its volunteers are not affiliated with or endorsed by the IRS or its employees. Deciding to obtain representation from the North Georgia LITC will not result in the IRS giving you preferential treatment in handling your dispute or problem and will not affect your rights before the IRS. The North Georgia LITC does not generally prepare tax returns or ITIN applications.

by Eric Santos | Jan 14, 2021 | Uncategorized

Too often, people with problems don’t know who they can turn to for help. Our tax laws continue to increase in complexity, and resolving these problems can be difficult and confusing.

Unfortunately, it is very often the most vulnerable taxpayers who pay the price. If you or someone you know needs help with tax issues, please reach out.

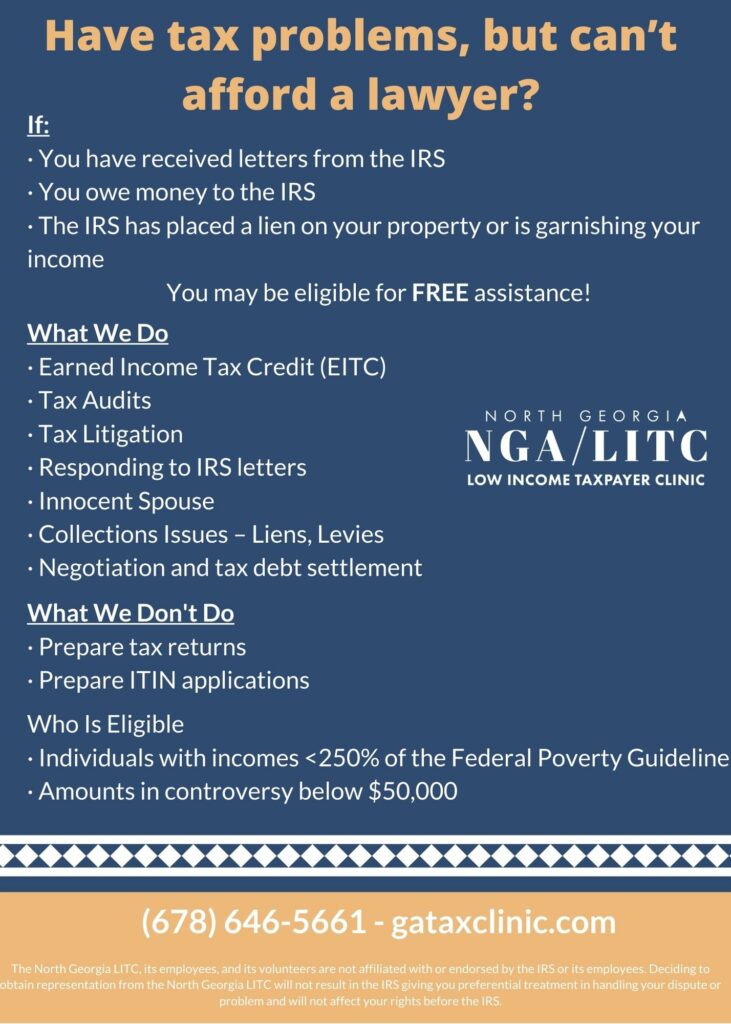

If:

- You have received letters from the IRS

- You owe money to the IRS

- The IRS has placed a lien on your property or is garnishing your income

- You may be eligible for FREE assistance!

What We Do

- Earned Income Tax Credit (EITC)

- Tax Audits

- Tax Litigation

- Responding to IRS letters

- Innocent Spouse

- Collections Issues – Liens, Levies

- Negotiation and tax debt settlement

What We Don’t Do

- Prepare tax returns

- Prepare ITIN applications

Who Is Eligible

- Individuals with incomes <250% of the Federal Poverty Guideline

- Amounts in controversy below $50,000

by Eric Santos | Jan 5, 2021 | Uncategorized

Below, are links to 13 counties and where you can find additional information about drop-off locations and how to submit your ballots for the Georgia Senate Runoff.

- Fulton County

- Cobb County

- DeKalb County

- Gwinnett County

- Henry County — Scroll down the page to the “Henry County Voting Information” header and select the “Absentee” tab for additional information.

- Butts County — The Butts County Administration Building is located at 625 West Third Street, Jackson, Georgia 30233

- Coweta County

- Clayton County — You can fill out an absentee form and print and sign an absentee ballot and mail it to Clayton County Elections & Registration at 121 S. McDonough St. Jonesboro, Georgia 30236. If you have additional questions, email elections@claytoncountyga.gov.

- Paulding County — To submit an absentee ballot application via email, please use the following address: absenteerequest@paulding.gov.

- Douglas County

- Cherokee County — Drop off your application at the “County Registrar’s Office” in Cherokee County, which is located at 2782 Marietta Hwy., Suite 100, Canton, Georgia 30114.

- Fayette County — Follow this link for information about voting by absentee ballot in Fayette County.

- Rockdale County — Ballots may be returned by USPS Mail or Express delivery or to “Office DropBox.” You can send absentee ballots to the Board of Elections and Voter Registration, 1261 Commercial Dr. SW., Suite B, Conyers, Georgia 30094. For additional questions, contact the office at 770-278-7333 or by email at absentee@rockdalecountyga.gov.

Recent Comments